「搜索基金与收购式创业」

Chinese Version Released

Yiqao Wang, founder of Search Panda™, translated and brought to China Search Funds & Entrepreneurship Through Acquisition by Jan Simon and published it in collaboration with Shanghai University of Finance and Economics Press.

Search Panda™ Insights

On February 16th, the MIT Sloan School of Management hosted its 8th Annual Search Fund Summit. Investors, entrepreneurs, and advisors from across North America traveled to Boston to discuss the latest trends and prospects in the industry.

Annual summits held by major business schools are great opportunities for entrepreneurs to fundraise. Many investors still prefer to meet entrepreneurs in person before making a final decision. In just one day, entrepreneurs might engage in “coffee chats” with a dozen investors to expedite investment intentions.

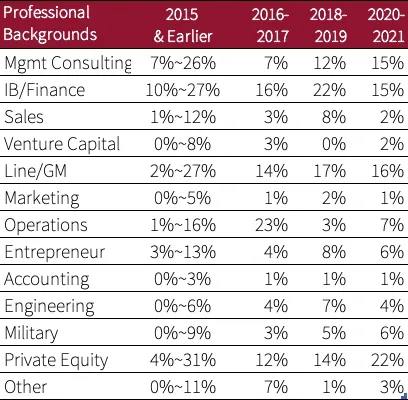

Investors pay close attention to the entrepreneurs, as the acquired businesses are mature and have proven market and product fit. Therefore, investors need to know if the entrepreneur can lead the company to grow sustainably, so they would like to see proof of certain knowledge, skills, and professional backgrounds. Many entrepreneurs come from top consulting firms, investment banks, hedge funds, or private equity funds, while others have served in important positions at large corporations.

The skills and experiences of entrepreneurs are just one aspect; investors also highly value their complex and diverse value orientations. Industry experts believe that successful acquisition entrepreneurs often possess seemingly contradictory but complementary traits:

Both Strategizing & Diving into the Fray

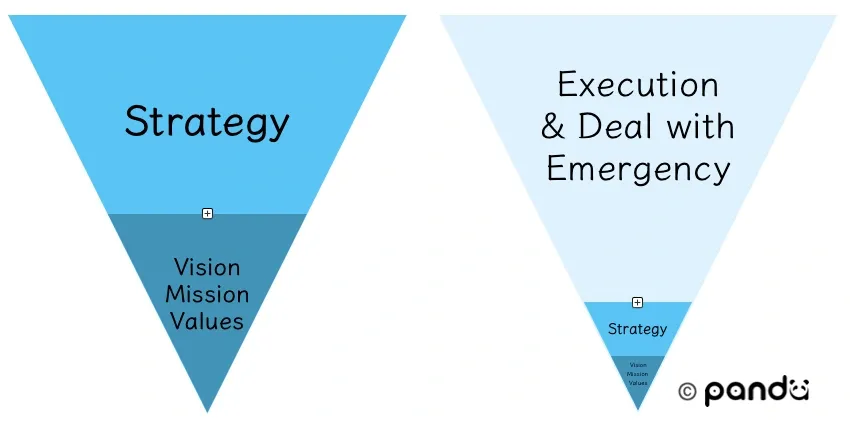

Founders who start businesses from scratch tend to be action-oriented, whereas managers of multinational corporations often work behind the scenes. An excellent acquisition entrepreneur should fall somewhere in between—because the acquired businesses are often not too large, lacking a well-developed governance structure, requiring the core leader to be hands-on; yet not too small, making strategic planning and capital allocation very important.

A Yale School of Management survey of 301 SME owners on time allocation showed that under the premise of financial good standing, most owners spend a lot of time on people issues and operational issues. Furthermore, they often struggle to allocate enough time for strategic planning, mission, vision, and values. Lastly, they believe they spend almost no time on external financing, procurement, and supplier management.

Chenmark is a comprehensive holding company that mainly searches for, acquires, and operates small and medium-sized businesses in North America. In the case Check Your Strategy and Capital Allocation Aspirations, Trish Higgins, who co-founded Chenmark after working for many years at renowned buy-side institutions Protege Partners and AQR in North America, shared that although strategic planning and capital allocation are important for CEOs of Chenmark’s businesses, they rarely engage in these activities. Instead, as the ultimate responsible persons, besides daily operations, they spend a lot of time on random, unexpected, or issues that are beyond the capabilities of employees.

Acquisition entrepreneurs need to make far-reaching strategic decisions and resource allocation plans in a limited time, and spend a lot of time executing strategies and handling emergencies. Although achieving this “asymmetrical” balance is quite difficult, Trish still believes that being the CEO of an SME is a very meaningful and fulfilling job.

Reasonable Returns & Pursue Passion

Anyone undertaking any venture must understand its financial return. Currently, in North America, successful acquisition entrepreneurship can bring about a personal equity return of 6 to 7 million dollars; as a CEO, there is also a salary, ranging from 200 to 300 thousand dollars.

If an entrepreneur aims for the stars and seeks financial returns of tens of millions of dollars or more, entrepreneurship through acquisition may not be the best choice. However, with nearly a 50% chance of success, entrepreneurship through acquisition offers very stable and considerable return expectations compared to the “one in a thousand” chance of disruptive innovation.

Besides financial returns, those engaged in entrepreneurship through acquisition often consider and pursue multiple aspects of business and life. Being the actual manager of a company, they have more autonomy over work content and scheduling. Some love to create certain products and services and the companies they acquire have the appropriate resources and consumer base; some have a passion for mission execution and value creation, hoping their acquired companies can have a positive impact on society; and some serial entrepreneurs simply love the experiences and processes of acquisition entrepreneurship, enjoying everything from customer growth, team building, system improvement, to other daily operations.

Passion, Wealth, and Happiness Formula, Source: Yale SOM Case

Alex Stavros grew up in the slums of Lima, Peru, where his parents were local missionaries. Before encountering acquisition entrepreneurship, he worked for many years at Cambridge Associates, accumulating extensive investment consulting experience. After graduating from Stanford Business School, he searched for and acquired a behavioral health agency, Embark, and developed it into an institution focused on improving the mental health and substance abuse issues of children, adolescents, and young adults. Alex believes that acquisition entrepreneurs need to connect the company’s mission with their personal mission, and various factors, such as his upbringing and parents’ teachings, make him want to benefit others by running such a business—creating value through Embark is now his life’s calling.

On the path of entrepreneurship through acquisition, the pursuit of financial returns and passion for entrepreneurship are both indispensable. If one is only after financial gains, there are many other lucrative career options; if one is solely driven by entrepreneurial passion, the venture might become unsustainable without capital support. Alex believes that entrepreneurs should listen to themselves and know what they truly want.

Take Risk & Stay Safe

Like other types of entrepreneurs, a spirit of adventure is a typical trait of acquisition entrepreneurs.

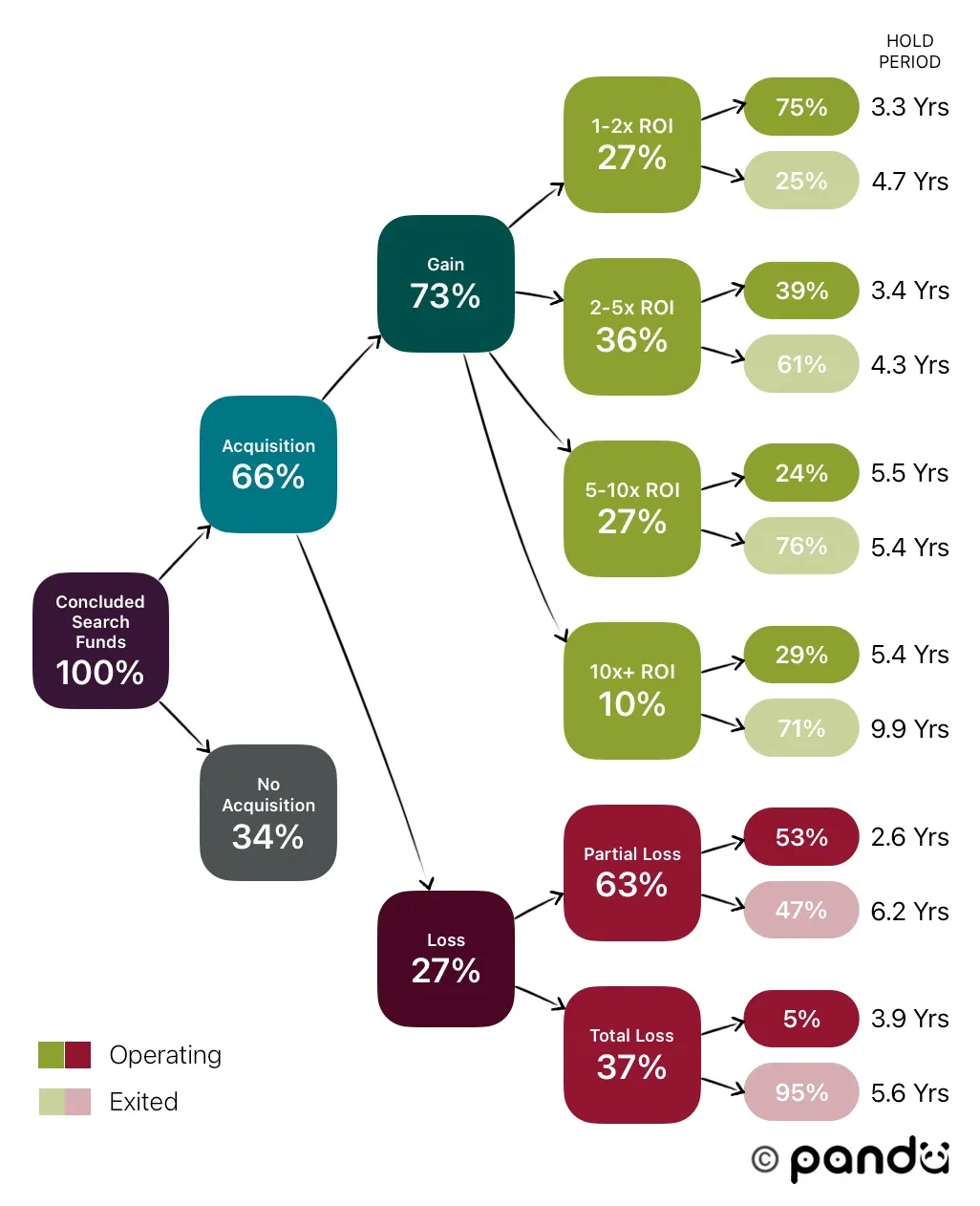

Internationally, the most common form of entrepreneurship through acquisition is the “search fund”. Stanford University Graduate School of Business 2022 study showed that 66% of acquisition entrepreneurs found and acquired target companies within the search period, and 57% of them achieved more than double the growth. Other acquisition entrepreneurs either failed to find good companies or managed them poorly after the acquisition. Furthermore, many people end their journey early due to failed fundraising.

Unlike other types of entrepreneurship, successful acquisition entrepreneurs are aware of the above public data before fundraising, but still embark on the entrepreneurial journey.

Source: Stanford Search Fund Study 2022

Another difference is that the most important ability of acquisition entrepreneurs is to lead a small or medium-sized business to steady development and incremental innovation, rather than attempting disruptive innovation for exponential growth.

From the perspective of search fund investors, to increase the success rate, investors advise acquisition entrepreneurs to search for and acquire businesses with stable cash flows. For example, some potential target companies have been running smoothly for a long time even after their owners have “traveled the world”. Acquiring such businesses can give the “parachuted CEO” some safe transition time to quickly familiarize themselves with the business and team, and explore the second growth curve without disrupting the original business model.

Having the courage to venture and the wisdom to maintain — these two seemingly contradictory traits are simultaneously present in successful acquisition entrepreneurs and are applied at different stages of entrepreneurship.

Enjoy Solitary & Actively Engage

As mentioned earlier, entrepreneurship through acquisition is not driven by “grand ideals” and remains a very niche way of entrepreneurship, making long-term perseverance even more important.

Harvard Business School professors Richard S. Ruback and Royce Yudkoff, in their book “Buying Small Businesses”, mentioned that acquisition entrepreneurs need to have vigorous energy and resilience to face challenges. They might search for months without finding any suitable deals; worse, some might go through multiple rounds of due diligence and negotiation, only for the business owner to decide not to sell at the last minute.

Entrepreneurs mostly experience various hardships and joys in solitude, which is not easily shared with others. Believing in perseverance and maintaining momentum is key to success.

Source: Dall-E

Although acquisition entrepreneurs often walk alone, it does not mean they are not articulate. On the contrary, successful individuals in this field are adept at proactively seeking support from stakeholders—the success of the business depends on cooperation and win-win relationships with investors, strategic partners, customers, and team members.

Jan Simon, managing partner of Vonzeo Capital, mentioned in his book Search Funds and Entrepreneurial Acquisitions that raising funds is a two-way selection process. Investors choose whether to invest in you, and you also choose which investors to accept support from. Ensure your investor team can provide support at every key stage of the search, including extensive acquisition entrepreneurship experience, sufficient acquisition capital, professional due diligence capabilities, abundant local industry resources, and management experience and mentorship, among others.

On a personal level, entrepreneurs also need to seek understanding and companionship from their spouses and families, who will inevitably be affected—achieving business success at the expense of family happiness is not desirable.

Being able to act as a “lonely warrior” perfecting the business, and also as an “opinion leader” coordinating different demands of stakeholders and winning support, successful acquisition entrepreneurs can flexibly switch between various identities and leadership styles.

Deciding to engage in acquisition entrepreneurship is a very personal decision, and everyone’s reasons vary. We have listed some typical characteristics and qualities of successful acquisition entrepreneurs, hoping to help potential entrepreneurs interested in this field but unsure if it suits them. Indeed, the required traits and qualities may differ in different political, economic, and cultural environments. Nonetheless, as a reference, past data insights can help entrepreneurs make clearer decisions.

If you are interested in acquisition entrepreneurship, you are welcome to join the Search Panda™ ETA community.

Reference:

Ruback, R.S., & Yudkoff, R., Buying a Small Business, Harvard Business Review, 2017

Simon J., Search Funds and Entrepreneurial Acquisitions, 2021

Yale School of Management, Check Your Strategy and Capital Allocation Aspirations, 2023; Eight Questions Aspiring Search Fund Entrepreneurs Should Consider Before Launching Their Project, 2023; Exploring Search Fund Entrepreneur Economics, 2023; Exploring Search Fund Entrepreneurship using Maslow’s Hierarchy of Needs as a Framework, 2023; On the Nature of Passion in an Entrepreneurial Journey, 2021; Ten Reasons to Absolutely not Pursue Entrepreneurship through Acquisition, 2023.